I. Trading Strategy

Source: Kaufman, P. J. (2020). Trading Systems and Methods (Chapter 5: The Livermore System). New Jersey: John Wiley & Sons, Inc. Concept: Trading strategy based on Jesse Livermore‘s approach to swing trading with DeMark pivots. Research Goal: Performance verification of Pivot Size and Penetration Filter. Specification: Table 1. Results: Figure 1-2. Trade Entry/Exit: Table1. Portfolio: 42 futures markets from four major market sectors (commodities, currencies, interest rates, and equity indexes). Data: 40 years since 1980. Testing Platform: MATLAB®.

II. Sensitivity Test

All 3-D charts are followed by 2-D contour charts for Profit Factor, Sharpe Ratio, Ulcer Performance Index, CAGR, Maximum Drawdown, Percent Profitable Trades, and Avg. Win / Avg. Loss Ratio. The final picture shows sensitivity of Equity Curve.

Tested Variables: Pivot_Size & Penetration_Filter (Definitions: Table 1):

Figure 1 | Portfolio Performance (Inputs: Table 1; Commission & Slippage: $0).

| STRATEGY | SPECIFICATION | PARAMETERS |

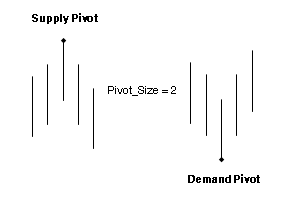

| Auxiliary Variables: | Pivot Points (DeMark Definition): Supply Pivots are surrounded on either side by lower highs. Demand Pivots are surrounded on either side by higher lows. The significance of pivot points is determined by the number of surrounded highs and lows. For example, a low that has two higher lows on either side has Pivot_Size = 2.

|

Pivot_Size = [1, 40], Step = 1; |

| Setup: | N/A | |

| Filter: | Noise: Noise is defined as the Average True Range (ATR) multiplied by Penetration_Filter. |

Penetration_Filter = [0.0, 4.0], Step = 0.1; |

| Entry: | Long Trades: A buy at the open is placed after penetration of two most recent Supply Pivots increased by Noise. Short Trades: A sell at the open is placed after penetration of two most recent Demand Pivots decreased by Noise. |

|

| Exit: | Pivot Exit: Long Trades: A sell at the open is placed after penetration of the most recent Demand Pivot decreased by Noise. Short Trades: A buy at the open is placed after penetration of the most recent Supply Pivot increased by Noise. Stop Loss Exit: ATR(ATR_Length) is the Average True Range over a period of ATR_Length. ATR_Stop is a multiple of ATR(ATR_Length). Long Trades: A sell stop is placed at [Entry − ATR(ATR_Length) * ATR_Stop]. Short Trades: A buy stop is placed at [Entry + ATR(ATR_Length) * ATR_Stop]. |

ATR_Length = 20; ATR_Stop = 6; |

| Sensitivity Test: | Pivot_Size = [1, 40], Step = 1 Penetration_Filter = [0.0, 4.0], Step = 0.1 |

|

| Position Sizing: | Initial_Capital = $1,000,000 Fixed_Fractional = 1% Portfolio = 42 US Futures ATR_Stop = 6 (ATR ~ Average True Range) ATR_Length = 20 |

|

| Data: | 42 futures markets; 40 years (1980/01/01−2020/2/28) |

Table 1 | Specification of Trading Strategy.

III. Sensitivity Test with Commission & Slippage

Tested Variables: Pivot_Size & Penetration_Filter (Definitions: Table 1):

Figure 2 | Portfolio Performance (Inputs: Table 1; Commission & Slippage: $100 Round Turn).

IV. Benchmarking

We benchmark the base case strategy against alternatives:

Case #1: Pivot_Size = 20; Penetration_Filter = 0.00 (Base Case).

Case #2: Pivot_Size = 20; Penetration_Filter = 0.50.

Case #3: Pivot_Size = 20; Penetration_Filter = 1.00.

Case #4: Pivot_Size = 20; Penetration_Filter = 2.00.

| Fixed Fractional Sizing |

Case #1 | Case #2 | Case #3 | Case #4 |

| Net Profit ($) | 396,629,571 | 441,445,002 | 282,228,015 | 418,466,049 |

| Sharpe Ratio | 0.85 | 0.87 | 0.82 | 0.88 |

| Ulcer Performance Index (UPI) | 0.99 | 1.01 | 0.93 | 1.25 |

| Profit Factor | 1.20 | 1.26 | 1.29 | 1.43 |

| CAGR (%) | 16.08 | 16.39 | 15.11 | 16.24 |

| Max. Drawdown (%) | (50.82) | (50.17) | (47.96) | (43.69) |

| Percent Profitable Trades (%) | 39.86 | 40.58 | 39.32 | 38.77 |

| Avg. Win / Avg. Loss Ratio | 1.81 | 1.84 | 1.99 | 2.25 |

Table 2 | Inputs: Table 1; Fixed Fractional Sizing: 1%; Commission & Slippage: $100 Round Turn.

V. Basic Concepts

Edwin Lefevre, Reminiscences of a Stock Operator (1923):

After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine – that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.

The reason is that a man may see straight and clearly and yet become impatient or doubtful when the market takes its time about doing as he figured it must do. That is why so many men in Wall Street, who are not at all in the sucker class, not even in the third grade, nevertheless lose money. The market does not beat them. They beat themselves, because though they have brains they cannot sit tight. Old Turkey was dead right in doing and saying what he did. He had not only the courage of his convictions but the intelligent patience to sit tight.

VI. Rating: The Livermore System: Part 2 | Trading Strategy

A/B/C/D

VII. Summary

The trading model based on DeMark Pivots and Penetration Filter performs slightly better than the original swing model.

Related Entries: The Livermore System: Part 1 (Filters) | Dow Theory – Trend (Entry & Exit) | Dow Theory – Multiple Time Frames (Entry)

Related Topics: (Public) Trading Strategies

Proprietary Strategies:

CFTC RULE 4.41: HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

RISK DISCLOSURE: U.S. GOVERNMENT REQUIRED DISCLAIMER | CFTC RULE 4.41

Codes: matlab/livermore/2

The post The Livermore System: Part 2 | Trading Strategy (Filters) appeared first on Oxfordstrat.